Benchmark Stock Market Indices Hit Fresh Record Highs

Benchmark Stock Market Indices Hit Fresh Record Highs

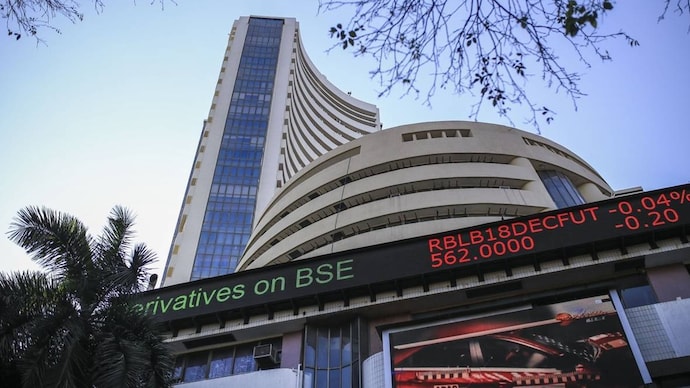

Mumbai, July 3, 2024 – The Indian stock markets reached unprecedented heights today as trading commenced, driven by significant gains in heavyweight stocks, particularly HDFC Bank. This bullish trend saw the S&P BSE Sensex surpass the 80,000 mark for the first time in history, while the NSE Nifty50 recorded an all-time high of 24,292.15.

Key Highlights:

-

S&P BSE Sensex Milestone: The Sensex, a crucial indicator of market sentiment, crossed the psychological barrier of 80,000 points, reflecting robust investor confidence and strong economic fundamentals.

-

NSE Nifty50 Record: The Nifty50 also surged to a new peak, reaching 24,292.15 points. This performance underscores the broad-based rally across various sectors.

-

Heavyweight Stocks Lead the Charge: HDFC Bank played a pivotal role in this upward movement. The bank’s stellar performance, driven by positive quarterly results and optimistic future outlooks, significantly contributed to the indices’ ascent.

-

Broader Market Performance: The rally was not confined to a few stocks. Other sectors, including Information Technology, Pharmaceuticals, and Consumer Goods, also witnessed substantial gains, adding to the overall market momentum.

-

Investor Sentiment: Market experts attribute this surge to a combination of factors, including favorable government policies, strong corporate earnings, and positive global cues. The sustained foreign institutional investment also played a crucial role in bolstering market sentiment.

-

Economic Indicators: The latest economic indicators, such as GDP growth, industrial production, and consumer confidence, have been favorable, contributing to the positive outlook. The Reserve Bank of India’s accommodative monetary policy stance has also supported market liquidity and investor confidence.

Market Reactions:

Investors and analysts are optimistic about the market’s future trajectory, citing a strong macroeconomic environment and corporate earnings growth as key drivers. “The markets are reflecting the underlying strength of the Indian economy. With continued policy support and a positive earnings outlook, we can expect this bullish trend to persist,” said Anil Sharma, a market analyst.

Outlook:

As the markets continue to scale new heights, investors are advised to remain vigilant and consider long-term fundamentals while making investment decisions. While the current momentum is encouraging, experts caution against potential volatility and advise a diversified investment strategy to mitigate risks.

The historic highs achieved by the Sensex and Nifty50 today mark a significant milestone for the Indian stock markets, reinforcing their resilience and growth potential. As trading progresses, market participants will closely monitor economic developments and corporate performance to gauge future trends.