Why Not Free Hindu Temples? The Debate on Taxation and Secularism in India

Why Not Free Hindu Temples? The Debate on Taxation and Secularism in India

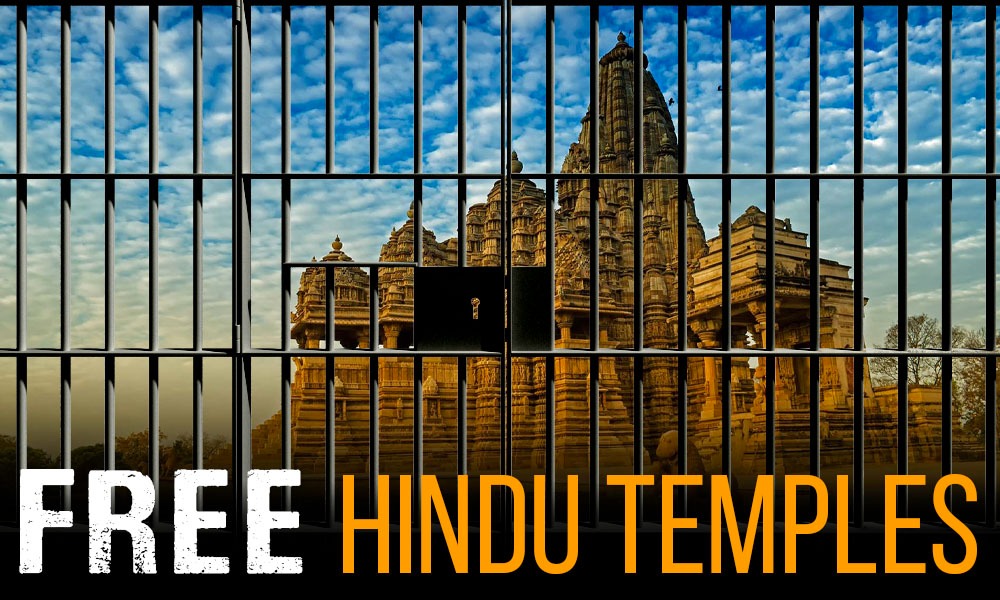

In India, a country celebrated for its rich cultural diversity and secular values, a persistent debate revolves around the taxation of Hindu temples. While secularism implies equal treatment of all religions, many Hindus feel that their temples are unfairly targeted by government taxation, while places of worship belonging to other religions often enjoy exemptions. This discrepancy raises questions about the principles of secularism and religious equality in the country.

The Taxation Controversy

Unlike other religious institutions, many Hindu temples in India are subject to government control and taxation. The revenue generated from these temples often goes into state treasuries, ostensibly to fund public services and welfare programs. However, this practice has drawn criticism from various quarters, including temple administrators, devotees, and political groups.

Critics argue that taxing Hindu temples while exempting mosques, churches, and gurdwaras from similar levies is inherently discriminatory. They contend that this selective taxation undermines the secular fabric of the nation and places an undue financial burden on Hindu religious institutions.

Historical Context and Government Control

The roots of government control over Hindu temples can be traced back to colonial times when British authorities enacted laws to manage temple affairs. Post-independence, several state governments continued this practice, citing reasons such as mismanagement and corruption within temple administrations.

Proponents of government control argue that it ensures transparency and accountability, preventing the misuse of temple funds. They claim that the revenue collected is used for the upkeep of the temples, as well as for broader social welfare initiatives.

However, opponents counter that such control often leads to bureaucratic inefficiencies and mismanagement. They advocate for the autonomy of Hindu temples, similar to the freedom enjoyed by religious institutions of other communities.

Financial Impact

The financial implications of taxing Hindu temples are significant. It is estimated that major temples like Tirupati Balaji in Andhra Pradesh, Shirdi Sai Baba in Maharashtra, and Sabarimala in Kerala collectively contribute billions of rupees annually. For instance, Tirupati Balaji alone generates approximately ₹3,000 crore (around $400 million) annually. Across India, it is estimated that Hindu temples contribute over ₹10,000 crore (approximately $1.3 billion) in revenue each year. This substantial amount, however, constitutes only a small fraction of India’s GDP, which stood at around $3.2 trillion in 2023. Thus, the revenue from Hindu temples makes up less than 0.04% of the total GDP, raising questions about the necessity and fairness of such taxation.

Legal and Political Dimensions

The issue of taxing Hindu temples has also found its way into the legal and political arenas. Several petitions have been filed in courts challenging the constitutional validity of state control and taxation of Hindu temples. These petitions argue that such practices violate the right to religious freedom guaranteed under the Indian Constitution.

Politically, the demand to “free Hindu temples” has gained traction among various Hindu nationalist groups and political parties. They argue that true secularism can only be achieved when the government ceases to interfere in the affairs of any religious institution, including Hindu temples.

Looking Forward

The debate over the taxation of Hindu temples in India is complex and multifaceted. While the principles of secularism and equality are at the core of the issue, practical concerns about transparency, accountability, and social welfare also play significant roles.

As the nation grapples with this contentious issue, it remains to be seen whether future reforms will address the grievances of Hindu temple administrators and devotees. A potential resolution could lie in a balanced approach that ensures both religious freedom and responsible management of temple resources.

In a truly secular nation, the treatment of religious institutions should reflect fairness and equality, respecting the sentiments of all communities while upholding the rule of law. Whether India can achieve this delicate balance is a question that continues to spark debate and reflection across the country.